#TAX FREE ZONE

Explore tagged Tumblr posts

Text

Apply for your residence visa over a 5-min video call, just like getting a Dubai business license without visiting a center

In a fast-paced world where convenience and efficiency are paramount, the United Arab Emirates (UAE) has set the bar high by offering a hassle-free way to obtain your residence visa via a simple 5-minute video call. This innovative approach makes securing your UAE residence visa as easy as obtaining a Dubai business license, all without setting foot in a center. In this blog, we will walk you through the process and explore the benefits of a UAE residence visa and setting up a company in Dubai with a Meydan Free Zone license.

Benefits of Having a UAE Residence Visa

A UAE residence visa brings with it a plethora of advantages. Here are some of the key benefits:

Residency: A UAE residence visa provides you with legal residence status, allowing you to stay in the country without the need for frequent visa runs.

Stability: You gain long-term stability, which is attractive for families looking to settle in the UAE or individuals seeking to establish themselves in the region.

Business Opportunities: As a UAE resident, you can explore numerous business opportunities in a thriving economy with tax incentives and a business-friendly environment.

Access to Services: You gain access to various services, including healthcare, education, and banking, on par with citizens.

Global Mobility: UAE residence visa holders can enjoy simplified travel with access to the UAE’s extensive network of international flight connections.

How to Apply for a UAE Residency Visa via Video Call

The process is remarkably simple:

Consultation: A 5-minute video call, the General Directorate of Residency and Foreigners Affairs (GDRFA) will process your visa virtually They will guide you through the process.

Document Submission: Prepare the necessary documents, such as your passport, proof of address, and other supporting documents, which will be provided to the setup service.

Video Call Appointment: Schedule a convenient time for a 5-minute video call with the UAE immigration authorities. During the call, you will provide biometric data and have the opportunity to address any concerns.

Visa Approval: Upon successful completion of the video call, you will receive your UAE residence visa, which can be easily renewed.

Why Should You Set Up a Company in Dubai with a Meydan Free Zone License?

Meydan Free Zone offers unique advantages for businesses:

100% Ownership: You can have full ownership of your company without the need for a local sponsor or partner.

Tax Benefits: Enjoy zero corporate and personal income tax for a set period, with the possibility of tax exemptions in the long term.

Strategic Location: Meydan Free Zone is strategically located, providing access to global markets through state-of-the-art infrastructure.

World-Class Facilities: Benefit from modern office spaces, warehouses, and excellent amenities for your business operations.

How to Get a Meydan Free Zone Company License

Getting a Meydan Free Zone license is straightforward:

Select a Business Activity: Choose the business activity that aligns with your goals and market niche.

Company Registration: Work with a business setup service to complete the registration process, which includes submitting the necessary documents.

License Issuance: Once approved, your Meydan Free Zone license will be issued, and you can begin your operations.

How to Legally Work with Mainland Companies with a Trade License from Meydan Free Zone

With a Meydan Free Zone trade license, you can legally do business with mainland companies:

Local Service Agent: Appoint a local service agent to facilitate your business dealings with mainland companies. This agent is not a business partner but is essential for legal compliance.

Legal Framework: Ensure that your business operations follow UAE laws and regulations to maintain a strong and compliant business relationship with mainland entities.

In conclusion, applying for a UAE residence visa via video call and establishing a business in Dubai with a Meydan Free Zone license offer an innovative and efficient pathway to unlock the myriad opportunities in the UAE. This streamlined process not only simplifies the visa application but also opens doors to a vibrant business ecosystem. Make your move and enjoy the benefits of both a UAE residence visa and a Meydan Free Zone company license without the need for physical visits.

M.Hussnain

Private Wolf facebook Instagram Twitter Linkedin

#dubai#DUBAI RESIDENCE VISA#MEYDAN FREE ZONE LICENSE#MEYDAN LICENSE#TAX FREE ZONE#UAE RESIDENCE VISA#VIDEO CALL REDIDENCE VISA

0 notes

Text

Consult with our Tax Experts in Dubai today and get the best financial advice! With us, you can grow your business in today’s fast-paced world. For more information, you can visit our website https://aoneaccounting.ae/ or call us at 971 - 44221190

0 notes

Text

Determine your business economic value with us! We, at AONE Accounting, are known for providing exceptional Business Valuation Services Dubai to all clients. Contact us today! For more information, you can visit our website https://aoneaccounting.ae/ or call us at 971 - 44221190

0 notes

Text

Key Updates and Compliance Strategies for Economic Substance Regulations from the MoF

The economic substance regulations (ESR) were introduced by the UAE’s Ministry of Finance (MoF) to align with global standards on transparency and prevent harmful tax practices. These regulations ensure that UAE-based businesses conducting certain activities have substantial economic presence in the country, rather than simply benefitting from tax advantages. Adhering to these rules is crucial for avoiding penalties and safeguarding the business’s reputation.

In this comprehensive guide, we will walk you through the MoF Economic Substance Regulations ESR, recent updates, compliance strategies, and the penalties that companies face for non-compliance.

Understanding UAE ESR Compliance Requirements

Under the UAE ESR compliance requirements, businesses that engage in “Relevant Activities” such as banking, insurance, shipping, intellectual property, lease finance, holding companies, and distribution and service center must meet certain economic substance criteria. Companies must demonstrate that they are conducting core income-generating activities (CIGAs) in the UAE, which involves having sufficient employees, physical assets, and incurring expenditure in the UAE proportional to the income generated from these activities.

Businesses are required to:

File an ESR notification annually through the Economic Substance Regulations UAE online MOF portal.

Submit an Economic Substance Report outlining their compliance with the regulations.

Pass the Economic Substance Test in UAE, which assesses whether the company has sufficient economic presence in the UAE.

Non-compliance with these requirements can result in ESR penalties and fines UAE, including the exchange of information with foreign tax authorities, damaging a company’s reputation internationally.

ESR Penalties and Consequences for Non-Compliance

The UAE Economic Substance Regulations impose various penalties for non-compliance, ranging from fines to more serious administrative actions. These include:

Failure to Submit ESR Notification:

Penalty: AED 20,000

Consequence: Non-filing will lead to immediate penalties and increased scrutiny for future compliance.

Failure to Submit the Economic Substance Report:

Penalty: AED 50,000

Consequence: Businesses that fail to submit their Economic Substance Report will not only face penalties but could also be reported to international tax authorities.

Failure to Meet the Economic Substance Test:

Penalty (First Year): AED 50,000

Penalty (Subsequent Year): AED 400,000

Consequence: Failing to meet the Economic Substance Test can result in heavy fines and, in severe cases, the suspension or non-renewal of the company’s business license.

Providing Inaccurate Information:

Penalty: AED 50,000

Consequence: Providing false or misleading information in the ESR notification or Economic Substance Report can result in severe financial penalties and reputational damage.

Failure to Maintain Proper Records:

Penalty: AED 50,000

Consequence: Businesses must keep detailed records of their core income-generating activities (CIGAs). Failure to maintain these records can lead to audits and further penalties.

Other Consequences:

Exchange of Information: If a business is found non-compliant, the Ministry of Finance may exchange information about that company with foreign tax authorities. This could affect a company’s international reputation and operations.

License Suspension or Revocation: The Ministry of Finance may take administrative action, including suspending or revoking business licenses, especially for repeat offenders.

Compliance Strategies for UAE Businesses

To avoid penalties, companies should adopt a proactive approach toward compliance. Here are several strategies that will ensure businesses meet all UAE ESR compliance requirements:

Follow a UAE ESR Compliance Checklist: Having a thorough UAE ESR compliance checklist is essential. The checklist should cover all aspects, from ESR notification filing to passing the Economic Substance Test in UAE. Monitoring submission deadlines and ensuring all relevant documents are prepared is vital to avoiding penalties.

Seek Filing Assistance: ESR filing assistance UAE can ensure that your business submits accurate Economic Substance Reports on time. Assistance can also help mitigate the risk of providing incorrect information, which could otherwise lead to penalties.

Regular Audits: Conduct Economic Substance compliance audits UAE to ensure that your business is consistently meeting the economic substance requirements. This is particularly important for businesses in UAE free zones or offshore entities that are subject to increased scrutiny.

How MBG Can Help: ESR Compliance Services UAE

At MBC Legal Consultants, we provide specialized ESR compliance services to help businesses navigate the complex MoF Economic Substance Regulations framework.

Our services include:

ESR advisory services: Tailored guidance to help businesses understand their obligations.

Filing assistance: Helping companies with timely ESR notification filing UAE and Economic Substance Notification and Report submission.

ESR audit services UAE: Conducting thorough audits to assess compliance with the UAE Economic Substance Regulations.

Legal support: Offering legal advisory services on how to meet ESR compliance requirements UAE, ensuring your business is fully compliant with UAE ESR laws for businesses.

As Economic Substance Regulations continue to evolve, businesses need to stay informed and compliant to avoid penalties and reputational damage. The consequences of non-compliance are severe, with significant fines, administrative actions, and possible international repercussions.

By adopting compliance strategies, including seeking UAE ESR advisory services and leveraging professional help for ESR filing assistance, businesses can ensure they meet the MoF Economic Substance Regulations. Contact MBG Legal Consultants for expert assistance in navigating the complex requirements and ensuring that your business stays compliant.

#accounting#business#investing#economic substance regulations#ESR#MOF economic substance regulations#MOF#UAE Compliance#Business Regulations#Economic Presence#Tax Transparency#Compliance Strategies#Relevant Activities#Economic Substance Test#ESR Notification#ESR Report#Penalties#Fines#Non-Compliance Consequences#CIGAs#Filing Assistance#Audits#Legal Support#MBG Legal Consultants#Tax Regulations#Business Reputation#UAE Free Zones#Administrative Actions#International Tax Authorities#Reputational Risk

1 note

·

View note

Text

Corporate Tax Registration in UAE: A Comprehensive Guide

The UAE has long been known for its business-friendly environment, attracting entrepreneurs and investors from around the globe. However, with the introduction of corporate tax in the UAE, businesses now need to understand the new regulatory framework and ensure compliance. Corporate tax registration has become a vital step for all businesses, particularly those operating under a general trading license in Dubai or within the free zone company Dubai jurisdictions.

Understanding Corporate Tax in the UAE

Corporate tax in UAE is a direct tax imposed on the net income or profit of businesses. The UAE introduced corporate tax as part of its commitment to global transparency and regulatory standards. It applies to most business activities, except for entities involved in the extraction of natural resources, which are subject to emirate-level taxation.

Who Needs to Register for Corporate Tax?

Any business operating in the UAE, including those in the Dubai trade license system, whether mainland or free zone, must register for corporate tax if their taxable income exceeds a certain threshold.

Why Compliance Matters?

Staying compliant with corporate tax laws in the UAE not only helps businesses avoid penalties but also enhances their reputation in the market. Compliance indicates a company’s commitment to transparent operations and helps attract international investors who prioritize working with businesses that follow global standards.

A few final thoughts

Registering for corporate tax can seem daunting, but with the right guidance, it becomes a manageable process. InZone provides expert services to help businesses register for corporate tax efficiently and ensures that you stay compliant with all tax regulations and continue to enjoy the benefits of operating in the UAE’s thriving economy.

#business setup in dubai#business license#corporate tax in uae#corporate tax in dubai#dubai free zone

0 notes

Text

#corporate tax penalty#business tax in uae#corporate tax in uae#corporate tax uae free zone#corporate tax rate uae

0 notes

Text

Corporate Tax in the UAE: Everything You Need to Know

Corporate tax in UAE is a direct tax imposed on the net income or profit of companies. It is also termed “Business Profits Tax” in some jurisdictions. On 31 January 2022, the UAE Ministry of Finance (MoF) announced a new federal corporate tax (CT) system in the country with effect from 1 June 2023. The new corporate tax was introduced at a standard rate of 9%, the lowest within the GCC region. The key goal of introducing this system was to reduce the compliance burden on businesses and integrate best practices globally. Speak to the experts at Shuraa Tax and see how their services can elevate their business needs.

0 notes

Text

#corporate tax free zone#best corporate tax services in uae#top corporate tax services in uae#corporate tax#corporate tax in uae#corporate tax return#corporate tax services

0 notes

Text

Offshore company setup with DUBIZ

Forming an offshore company in the UAE is easy since only a certificate of incorporation is issued, and operating licenses aren’t required. However, knowing the rules and procedures for offshore company registration is still essential.

DUBIZ provides the fastest and safest solution for offshore company setup UAE. Just contact us, and we’ll handle the process for you!

#List of offshore company in uae#Top offshore company in uae#list of offshore companies in dubai#dubai offshore company requirements#Offshore company in uae for foreigners#offshore company dubai free zone#uae offshore company tax

0 notes

Text

Yes, your business in the free zone can live with 0% taxation only if they meet specific criteria by keeping in mind the new corporate tax law and how Al Zora does that let us explain. Check out the video for more information.

#accounting#corporate tax services in uae#corporate tax in dubai#corporate tax advisors#corporate tax consultants#tax#free zone

0 notes

Text

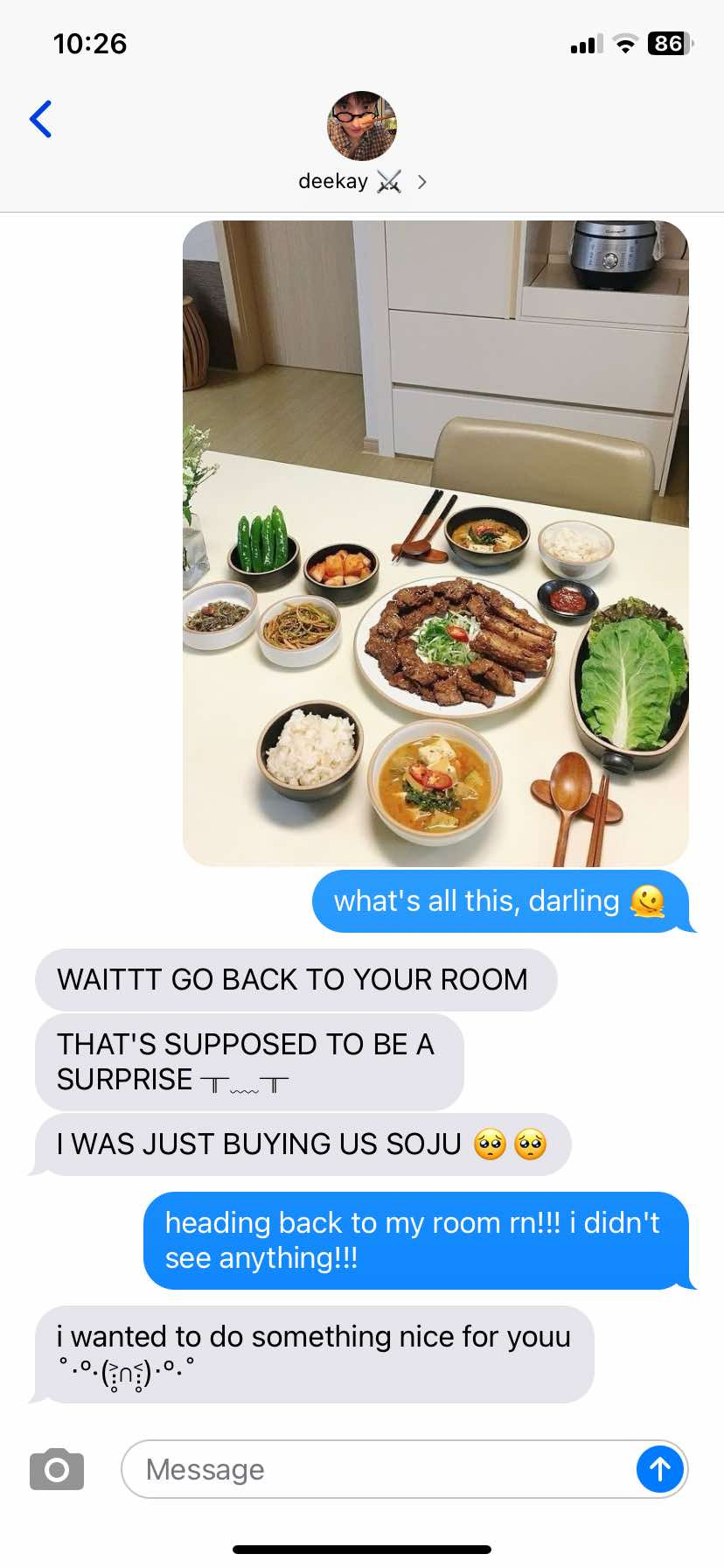

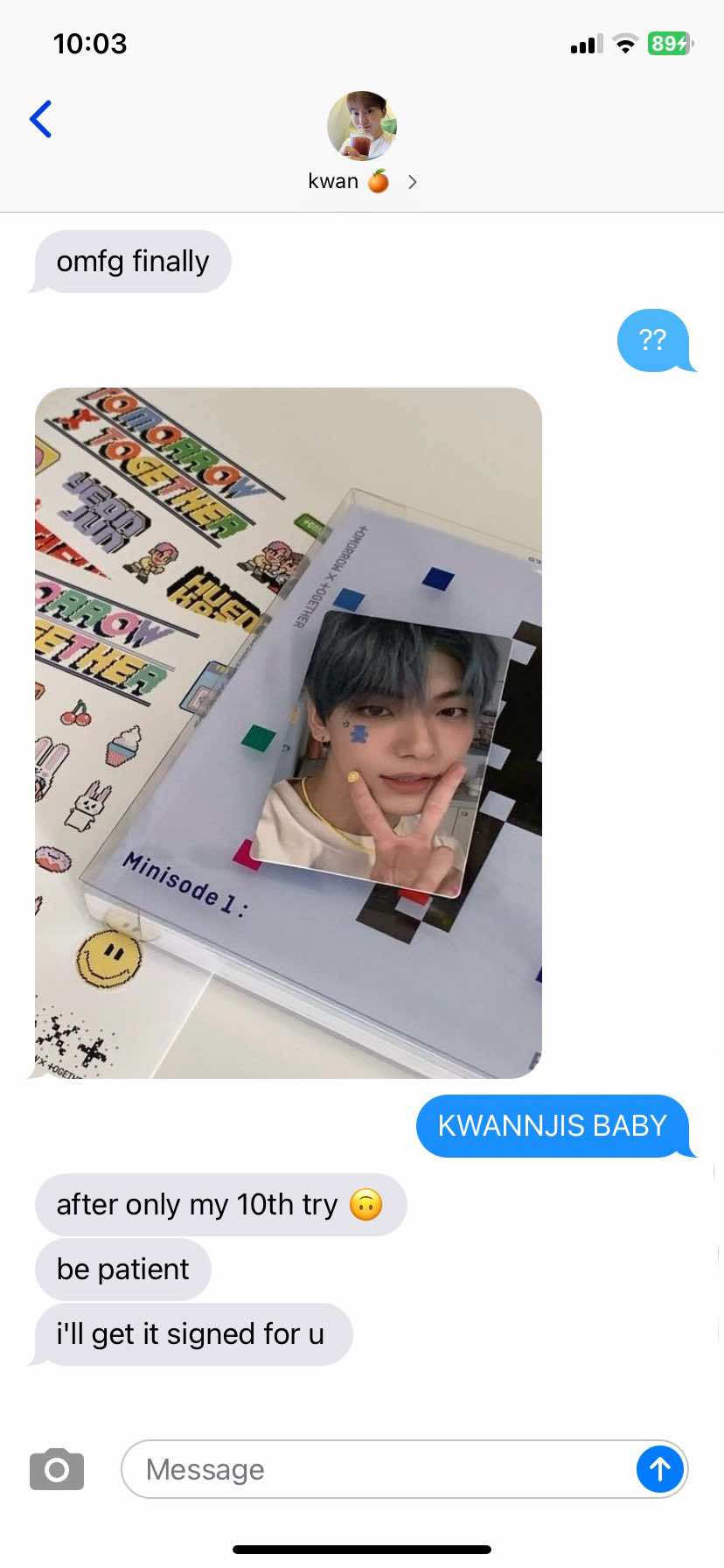

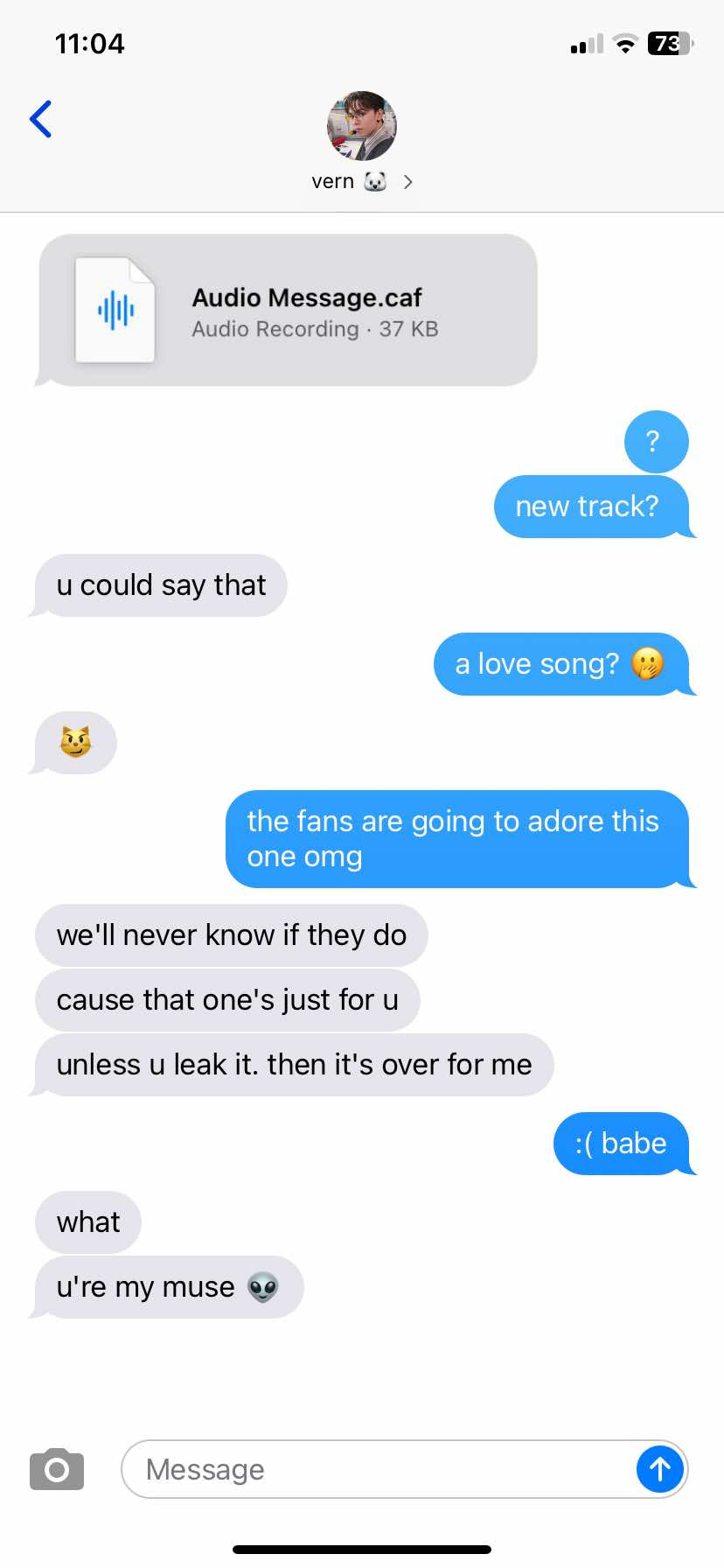

🍨 svt spoiling their partner.

★ prompt: how ot13 spoils their partner? 🥹🥹🥹 i am just a girl give me treats c/o @shinwonderful

ⓘ established relationship, pet names, fluff. headcanons under the cut. special thanks to @chugging-antiseptic-dye for helping! ♡

🍨 read more?

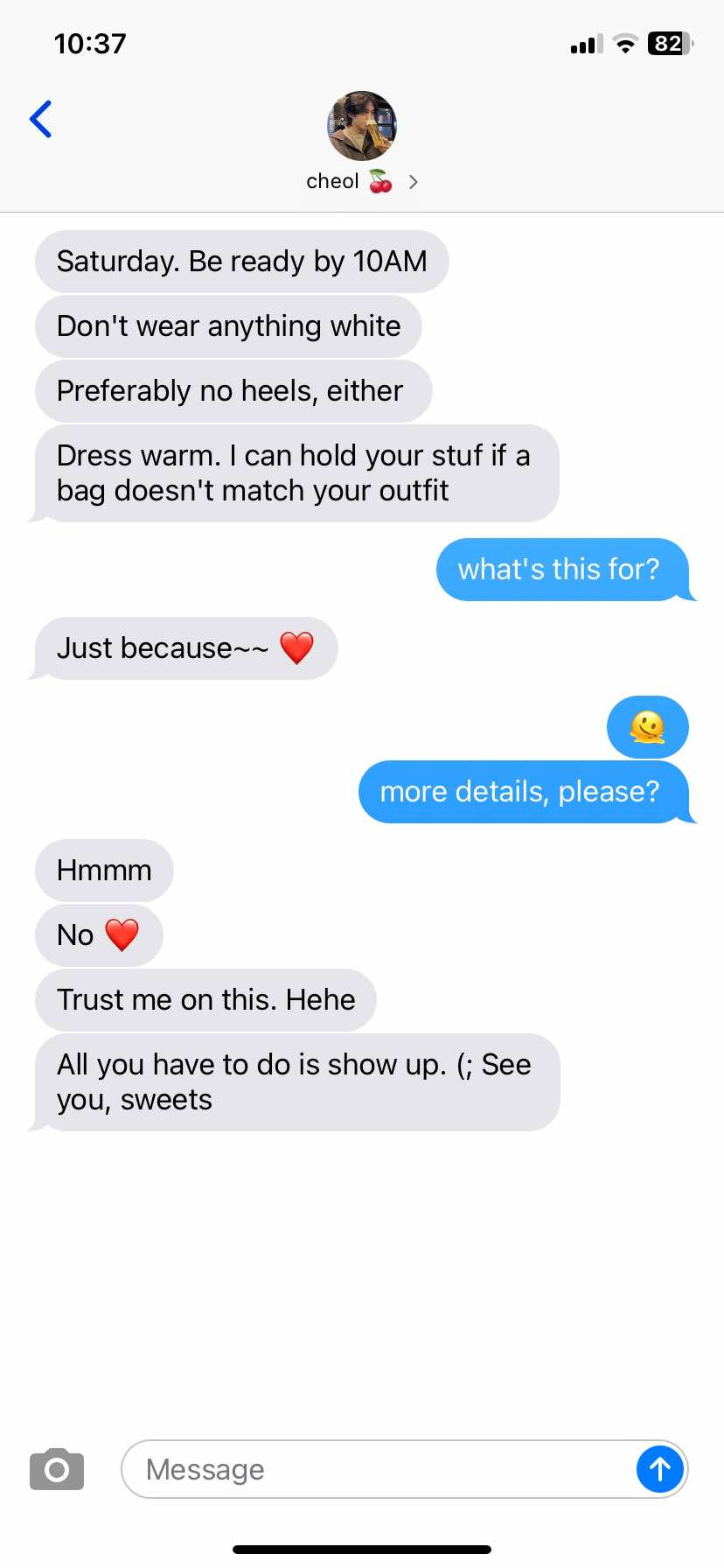

seungcheol 𖹭 planning dates. he will refuse to let you lift a finger for your day out. everything will be meticulously laid out, finetuned to be something that you'll enjoy. his goal is to lessen the mental load of decision-making and planning; he wants you to be able to focus solely on enjoying the surprise, and he'll break his back to make sure that happens.

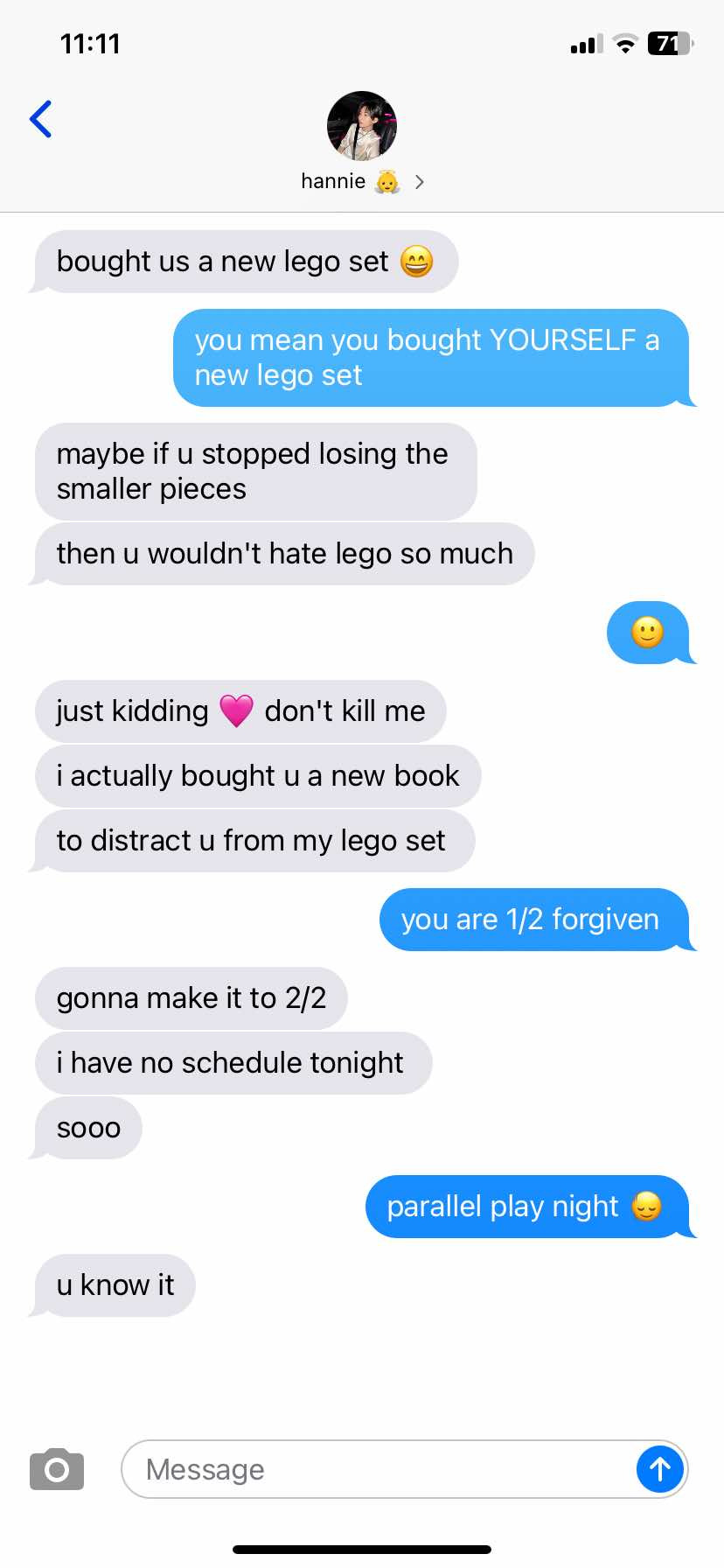

jeonghan 𖹭 'parallel play'. even if the two of you might not be interested in the same things, that's okay. he's happiest to spend quality time with you at home, where the two of you are free to do your own thing within eachother's presence. just being in your vicinity already makes him content, and so he plans everything around the two of you getting to explore and share your respective hobbies.

shua 𖹭 acts of service. need help with your taxes? need someone to fill up your tank? he's already on it. he'll say that these are all 'little things', call it the bare minimum, when it's apparent that he makes it a conscious effort to make your day-to-day easier. his brand of spoiling you comes in the form of quietly doing things that will improve your quality of life.

junhui 𖹭 buying clothes you'll like. he can't help it, really. when he sees an article of clothing that he thinks suits your style? when he finds a local brand that shares your advoacy? he's already pulling out his wallet. he likes the idea of dressing you up. nothing makes him happier than knowing you're wearing an outfit that he entirely picked out for you.

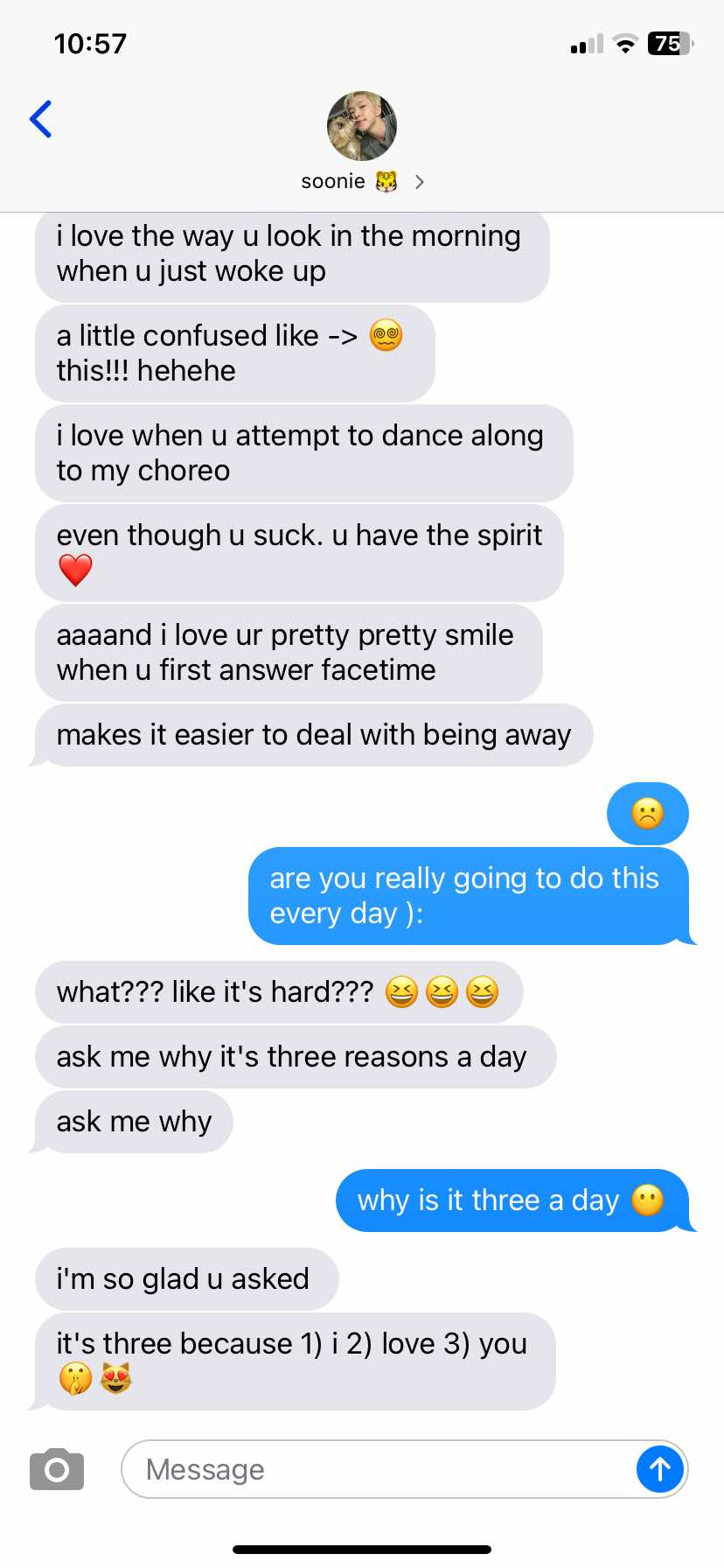

soonyoung 𖹭 daily reasons why he loves you. people always joke that he has a bit of a motormouth, so why shouldn't he use it on talking about you, you, you? he's big on words of affirmation, on making sure you never doubt how he feels for you. he'll point out the little and big things that make him adore you, and it's never the same reason twice.

wonwoo 𖹭 indulging your interests. he may not always understand these trends— blind boxes, must-have fashion pieces, et cetera— but he'll never make you feel bad about it. if there's anything that you want, he's already doing everything within his power to get it. his greatest joy is seeing your face light up once he's gotten you your 'priority' item; it's why he keeps doing it in the first place.

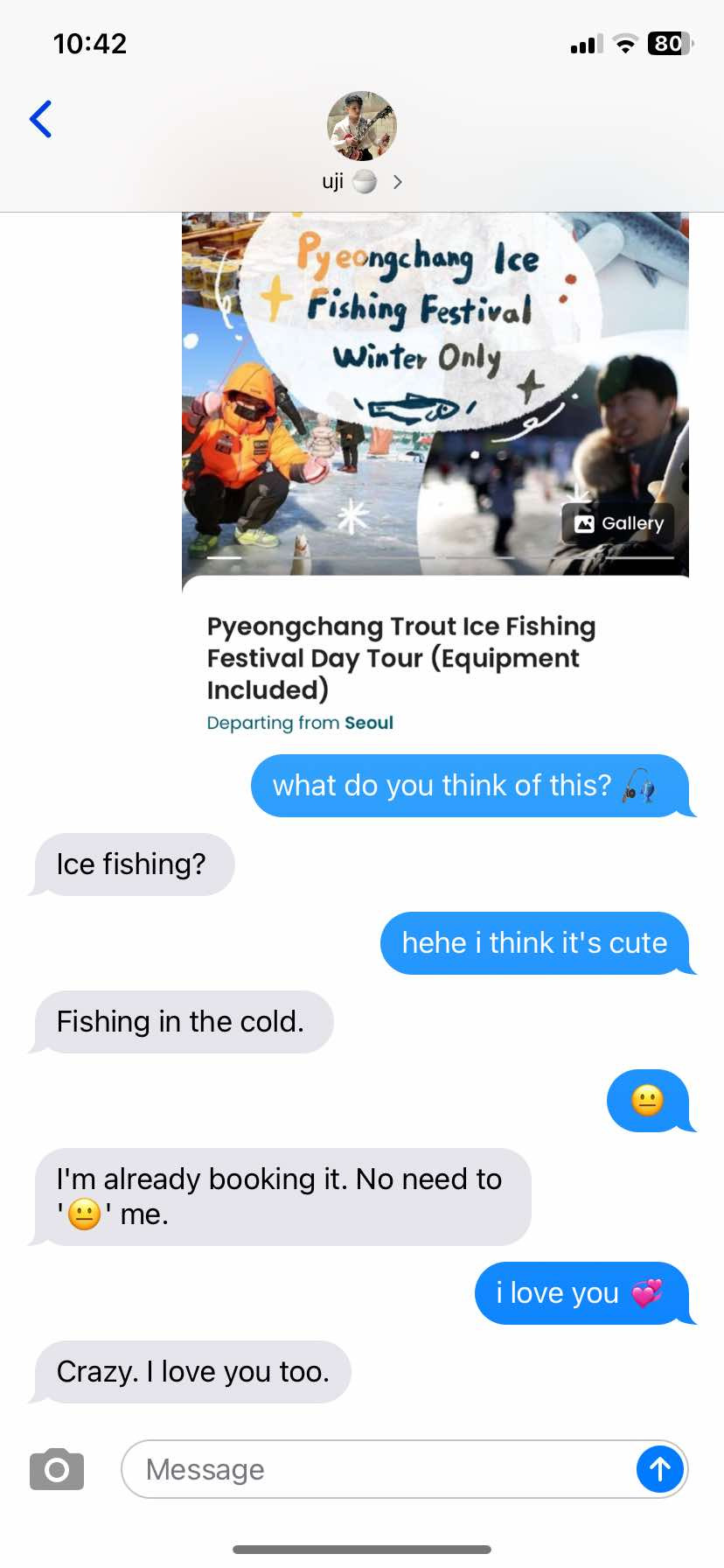

jihoon 𖹭 trying new things for you. there's a long list of things that jihoon never thought he'd do, but then he started dating you. time and time again, he willingly goes out of his comfort zone to accompany you on the little adventures and experiences that you ask to go on. he does these things scared, does them anxious, does them begrudgingly,— does them all for you.

seokmin 𖹭 meals he thinks you'll like. he's the type to have dozens of tabs open for homemade recipes dot com. he knows he's an amateur at this, but he's undeterred in trying. whether it's a trending pastry on tiktok or the comfort meal that your mother makes you, he's determined to learn it so you're always eating well.

mingyu 𖹭 getting-to-know card games. he gives as good as he takes, which means mingyu's way is to listen and remember. a night where the two of you can just have deep conversations with no interruptions is his ideal evening. he will know he succeeded if the two of you end up talking until the sun rises, feeling like the hours haven't passed at all.

minghao 𖹭 postcards from tour stops. he loves art and he loves you. his postcards are pocket-sized reminders of those facts, always packaged with a few choice words that are sweet and sincere. his trinkets are very "i-got-you-this-because-it-reminded-me-of-you" in nature, and you know each one was purchased with you at the front of mind.

seungkwan 𖹭 getting you your favorites. he figures he should put his industry connections to use somehow. he's always amused by how happy you get over a rare photocard, signed album, or concert tickets, and so he keeps it up. buying dozens of albums, contacting other labels, bearing the arduous ticketing. your excitement at the end of it makes it all worth it.

vernon 𖹭 producing songs. he hadn't really pegged himself as the making-music-for-the-sake-of-it type until he met you. now, he revels in getting to send you a track that's for your ears only. all the lyrics just seems to flow naturally when it's you inspiring him, and so he sends you works-in-progress with reminders that you're the only intended audience.

chan 𖹭 at-home massages. he's all too familiar with the aches of an ailing body, so he knows exactly how and where to work on you. he always does what he calls 'the works'— a good bath, scented candles, essential oils. he lets you take your time, and he takes his time with you in helping you unwind.

› scroll through all my work ദ്ദി ˉ͈̀꒳ˉ͈́ )✧ ᶻ 𝗓 𐰁 .ᐟ my masterlist | @xinganhao

#svt x reader#seventeen x reader#svt fluff#seventeen fluff#svt imagines#seventeen imagines#svt smau#seventeen smau#── ᵎᵎ ✦ mine#── ᵎᵎ ✦ reqs#[ need this . Rn . pls ]

1K notes

·

View notes

Text

Hmmm hmmmmm

#If I go for that new job sure I’d spend twice as much getting to work#but I’d get a travel card so all my buses would be free#and I spent some time looking at zone maps#and I genuinely believe I could avoid going into zone 1 stations altogether#like anywhere I tend to go in zone 1 is either a short walk or short bus from a zone2 station that I can reach without much difficulty#I think overall I’d spend around the same maybe potentially less on travel#not 2 mention if I was working in Whitechapel and had a gig in Shoreditch that’s like. rly close#also if I go for the supervisor job. yeh. significant pay rise#i did the after tax calcs#I could live well. spend more than I currently do. and save £500 a month. damn#I could actually afford holidays#😳😳😳

1 note

·

View note

Text

Consult with our Financial Advisors in Dubai and reach your financial goals easily! We, at AONE Accounting, are one of the top companies that help clients make their processes smooth. For more information, you can visit our website https://aoneaccounting.ae/ or call us at 971 - 44221190

0 notes

Text

#Company Formation in Dubai#Business Setup Services in Dubai#Company Registration in Dubai#Free zone Company Registration in Dubai#Vat Return Filing in Dubai#Vat Filing Services in Dubai#Accounting and Bookkeeping Services in Dubai#Bookkeeping Services in Dubai#Relocation Services Dubai#Bank Account Opening in Dubai#Tax Consultants in Dubai

0 notes

Note

You are veeeeery awesome

Update: Dorothea Disturb is actually the best brawl deck

#asks#you only have to pay commander tax for each time you cast it from the command zone#casting from the graveyard is basically free#white/blue also gets so many cheap tricks to nullify enemy commanders#wash away. tamiyo's compleation. curse of silence. witness protection. intercessor's arrest. prison sentence. planar disruption. sludge mon#sludge monster. sorry there were so many i ran into the tag limit#i could even run invoke the winds if i were confident in my mana base

1 note

·

View note